The Rise Of Cryptocurrency In Decentralized Finance A New Era Of Financial Freedom

The decentralized finance revolution has been brewing for some time, and at its forefront is the explosive growth of cryptocurrency. As we continue to navigate this new landscape, one thing is clear: the era of traditional finance as we know it is coming to an end. In its place, a new paradigm of financial freedom is emerging – one that is borderless, transparent, and community-driven.

- Unlocking The World Of Crypto Gaming: Your Essential Starter Pack

- Cryptocurrency Airdrops And Bounties: Unleashing The Power Of Free Digital Wealth

- Shielding Your Virtual Vault: Mastering The Art Of Crypto Security

- Embracing Transparency: How Blockchain Revolutionizes Secure Financial Transactions

- The Future Of Online Commerce: How Crypto Is Poised To Revolutionize The Way We Shop

It’s no secret that the 2008 financial crisis shook the very foundations of our global economy. But what’s less talked about is the spark it lit for innovation in the world of finance. Satoshi Nakamoto’s famous whitepaper, published in 2008, laid the groundwork for the first-ever decentralized cryptocurrency: Bitcoin. And though it would be years before it gained mainstream traction, the seed had been planted.

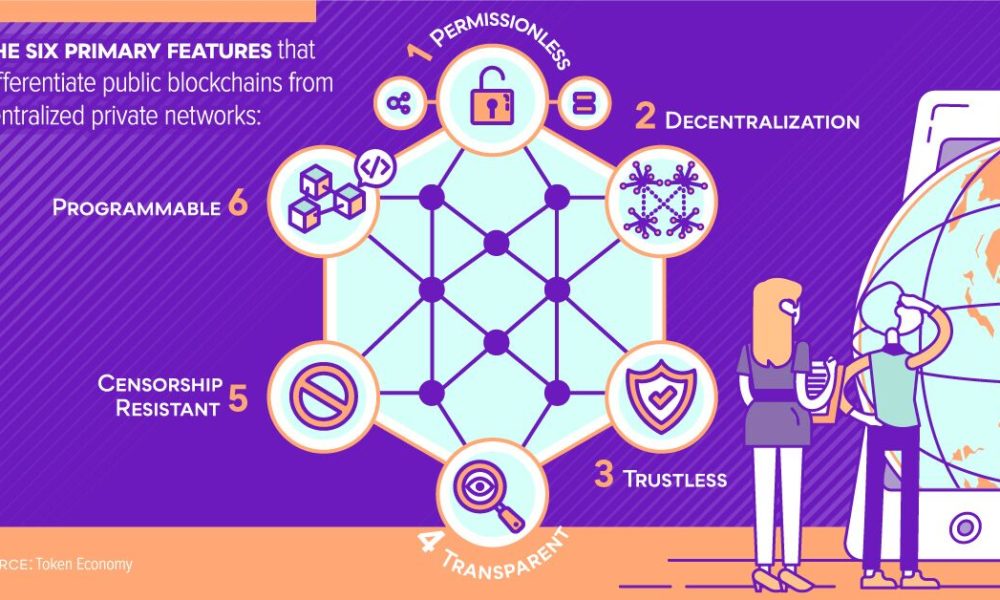

Fast-forward to today, and we’re witnessing an explosion of decentralized finance (DeFi) options. Cryptocurrencies like Ethereum, Polkadot, and Solana have burst onto the scene, each with their own unique value proposition and ecosystem. But what’s key is the ethos that underpins them all: a commitment to decentralization, and the democratization of financial access.

In practical terms, this translates into a wide range of exciting possibilities. For one, DeFi platforms are providing individuals and businesses with the tools they need to break free from the constraints of traditional finance. No longer are they beholden to banks and other intermediaries; now, they can interact directly with peers, exchange value, and manage risk in a trustless, transparent environment.

Take lending, for example. In traditional finance, access to credit is often based on a person’s credit score or collateral. But what about those who live in underserved communities, or lack the assets to secure a loan? DeFi lending protocols like Compound and Aave are democratizing access to credit by using smart contracts to automate the process, eliminating the need for intermediaries and reducing the risk of bias.

Another area where DeFi is making waves is in the realm of stablecoins. These cryptocurrencies are designed to peg their value to a stable asset, like the US dollar, making them a hedge against market volatility. But more than that, they provide a means for individuals to store value and make transactions without having to convert to and from traditional currencies. It’s a liberation from the confines of traditional finance, and the benefits are already being felt.

Of course, no discussion of DeFi would be complete without mentioning the other elephant in the room: regulation. While some countries have been slow to adapt, governments and regulatory bodies are beginning to wake up to the reality of decentralized finance. In places like Singapore and Bermuda, for instance, progressive regulations are being put in place to encourage DeFi innovation, while in the US, there’s growing momentum behind clear guidelines for cryptocurrency.

It’s all about finding the balance between protecting consumers and encouraging growth. As decentralized finance continues to evolve, we’ll likely see a balancing act between freedom and security. But one thing’s for sure: this new era of financial freedom isn’t going anywhere anytime soon.

We’re witnessing a revolution in the way we think about finance. It’s decentralized, community-driven, and global. We’re rewriting the rulebook on how money moves, and we’re creating new possibilities for people all around the world.

In short, the future is decentralized – and the thrill is in being along for the ride.